1. What is an E-Way Bill?

E-Way Bill is the short form of Electronic Way Bill. It is a unique document/bill, which is

electronically generated for the specific consignment/movement of goods from one place to

another, either inter-state or intra-state.https://e-waybill1.blogspot.com/

2.When Should E-Way Bill be issued?

eWay bill will be generated when there is a movement of goods in a vehicle/ conveyance of

value more than Rs. 50,000 (either each Invoice or in aggregate of all invoices in a

vehicle/conveyance)

Therefore, eWay Bills must be generated on the common portal for all these types of

movements. For certain specified Goods, the eway bill needs to be generated

mandatorily even if the value of the consignment of Goods is less than Rs. 50,000:

1. Inter-State movement of Goods by the Principal to the Job-worker by Principal/

registered Job-worker,

2. Inter-State Transport of Handicraft goods by a dealer exempted from GST

registration.

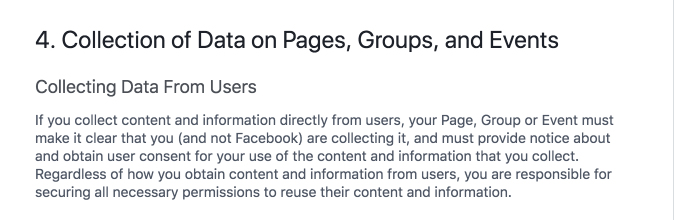

3. Who should Generate an E-Way Bill?

4. Cases when eWay bill is Not Required

In the following cases it is not necessary to generate e-Way Bill:

1. The mode of transport is non-motor vehicle

2. Consignor transporting goods to or from between place of business and a

weighbridge for weighment at a distance of 20 kms, accompanied by a Delivery

challan.

3. where the goods being transported are alcoholic liquor for human consumption, petroleum

crude, high speed diesel, motor spirit (commonly known as petrol), natural gas or aviation

turbine fuel

4. where the supply of goods being transported is treated as no supply under Schedule III of the

Act

5. ANNEXURE [(See rule 138 (14)]

1. Liquefied petroleum gas for supply to household and non domestic exempted category

(NDEC) customers

2. Kerosene oil sold under PDS

3. Postal baggage transported by Department of Posts

4. Natural or cultured pearls and precious or semi-precious stones; precious metals and metals

clad with precious metal (Chapter 71)

5. Jewellery, goldsmiths‘ and silversmiths‘ wares and other articles (Chapter 71)

6. Currency

7. Used personal and household effects

8. Coral, unworked (0508) and worked coral (9601)

Provided also that where the goods are transported for a distance of upto fifty kilometers within the

State or Union territory from the place of business of the consignor to the place of business of the

transporter for further transportation, the supplier or the recipient, or as the case may be, the

transporter may not furnish the details of conveyance in Part B of FORM GST EWB-01

Provided that where the goods are transported for a distance of upto fifty kilometers within the State

or Union territory from the place of business of the transporter finally to the place of business of the

consignee, the details of the conveyance may not be updated in the e-way bill.https://e-waybill1.blogspot.com/

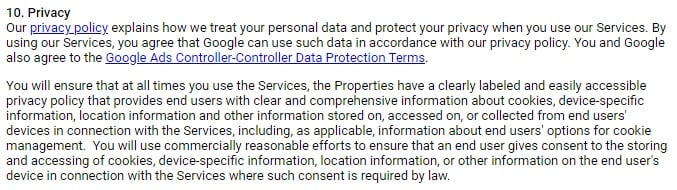

5. Validity of eWay Bill

An e-way bill is valid for periods as listed below, which is based on the distance travelled by the

goods. Validity is calculated from the date and time of generation of e-way bill-

Type of conveyance Distance Validity of EWB

For the purposes of this rule, the ―relevant date‖ shall mean the date on which the e-way bill has

been generated and the period of validity shall be counted from the time at which the e-way bill has

been generated and each day shall be counted as the period expiring at midnight of the day

immediately following the date of generation of e-way bill.

6. Cancellation of E-Way Bill

Where an e-way bill has been generated under this rule, but goods are either not transported or are

not transported as per the details furnished in the e-way bill, the e-way bill may be cancelled

electronically on the common portal, either directly or through a Facilitation Centre notified by the

Commissioner, within 24 hours of generation of the e-way bill. However, an e-way bill cannot be

cancelled if it has been verified in transit in accordance with the provisions of rule 138B of the CGST

Rules, 2017.

7. Penalty

If e-way bills, wherever required, are not issued in accordance with the provisions contained in Rule

138 of the CGST Rules, 2017, the same will be considered as contravention of rules. As per Section 122 of the CGST Act, 2017, a taxable person who transports any taxable goods without the cover of

specified documents (e-way bill is one of the specified documents) shall be liable to a penalty of

Rs.10,000/- or tax sought to be evaded (wherever applicable) whichever is greater. https://e-waybill1.blogspot.com/

8. Consolidated E-way Bill

where multiple consignments are intended to be transported in one conveyance, the transporter may

indicate the serial number of e-way bills generated in respect of each such consignment electronically

on the common portal and a consolidated e-way bill in FORM GST EWB-02 maybe generated by him on the said common portal prior to the movement of goods.

9. Rejection of E-way Bill

Where the person to whom the information specified in sub-rule (11) has been made available does

not communicate his acceptance or rejection within seventy two hours of the details being made

available to him on the common portal, or the time of delivery of goods whichever is earlier, it shall

be deemed that he has accepted the said details. https://e-waybill1.blogspot.com/

E-Way Bill is the short form of Electronic Way Bill. It is a unique document/bill, which is

electronically generated for the specific consignment/movement of goods from one place to

another, either inter-state or intra-state.https://e-waybill1.blogspot.com/

2.When Should E-Way Bill be issued?

eWay bill will be generated when there is a movement of goods in a vehicle/ conveyance of

value more than Rs. 50,000 (either each Invoice or in aggregate of all invoices in a

vehicle/conveyance)

Therefore, eWay Bills must be generated on the common portal for all these types of

movements. For certain specified Goods, the eway bill needs to be generated

mandatorily even if the value of the consignment of Goods is less than Rs. 50,000:

1. Inter-State movement of Goods by the Principal to the Job-worker by Principal/

registered Job-worker,

2. Inter-State Transport of Handicraft goods by a dealer exempted from GST

registration.

3. Who should Generate an E-Way Bill?

- Registered Person – E-way bill must be generated when there is a movement of goods of more than Rs 50,000 in value to or from a registered person. A Registered person or the transporter may choose to generate and carry eway bill even if the value of goods is less than Rs 50,000.

- Unregistered Persons – where a supply is made by an unregistered person to a registered person, the receiver will have to ensure all the compliances are met as if they were the supplier.

- Transporter – Transporters carrying goods by road, air, rail, etc. also need to generate e-Way Bill if the supplier has not generated an e-Way Bill.https://e-waybill1.blogspot.com/

4. Cases when eWay bill is Not Required

In the following cases it is not necessary to generate e-Way Bill:

1. The mode of transport is non-motor vehicle

2. Consignor transporting goods to or from between place of business and a

weighbridge for weighment at a distance of 20 kms, accompanied by a Delivery

challan.

3. where the goods being transported are alcoholic liquor for human consumption, petroleum

crude, high speed diesel, motor spirit (commonly known as petrol), natural gas or aviation

turbine fuel

4. where the supply of goods being transported is treated as no supply under Schedule III of the

Act

5. ANNEXURE [(See rule 138 (14)]

1. Liquefied petroleum gas for supply to household and non domestic exempted category

(NDEC) customers

2. Kerosene oil sold under PDS

3. Postal baggage transported by Department of Posts

4. Natural or cultured pearls and precious or semi-precious stones; precious metals and metals

clad with precious metal (Chapter 71)

5. Jewellery, goldsmiths‘ and silversmiths‘ wares and other articles (Chapter 71)

6. Currency

7. Used personal and household effects

8. Coral, unworked (0508) and worked coral (9601)

Provided also that where the goods are transported for a distance of upto fifty kilometers within the

State or Union territory from the place of business of the consignor to the place of business of the

transporter for further transportation, the supplier or the recipient, or as the case may be, the

transporter may not furnish the details of conveyance in Part B of FORM GST EWB-01

Provided that where the goods are transported for a distance of upto fifty kilometers within the State

or Union territory from the place of business of the transporter finally to the place of business of the

consignee, the details of the conveyance may not be updated in the e-way bill.https://e-waybill1.blogspot.com/

5. Validity of eWay Bill

An e-way bill is valid for periods as listed below, which is based on the distance travelled by the

goods. Validity is calculated from the date and time of generation of e-way bill-

Type of conveyance Distance Validity of EWB

- Other than Over dimensional cargo Less Than 100 Kms 1 Day

- For every additional 100 Kms or part thereof additional 1 Day

- For Over dimensional cargo Less Than 20 Kms 1 Day

- For every additional 20 Kms or part thereof additional 1 Day

- validity of the e-way bill may be extended within eight hours from the time of its expiry.

For the purposes of this rule, the ―relevant date‖ shall mean the date on which the e-way bill has

been generated and the period of validity shall be counted from the time at which the e-way bill has

been generated and each day shall be counted as the period expiring at midnight of the day

immediately following the date of generation of e-way bill.

6. Cancellation of E-Way Bill

Where an e-way bill has been generated under this rule, but goods are either not transported or are

not transported as per the details furnished in the e-way bill, the e-way bill may be cancelled

electronically on the common portal, either directly or through a Facilitation Centre notified by the

Commissioner, within 24 hours of generation of the e-way bill. However, an e-way bill cannot be

cancelled if it has been verified in transit in accordance with the provisions of rule 138B of the CGST

Rules, 2017.

7. Penalty

If e-way bills, wherever required, are not issued in accordance with the provisions contained in Rule

138 of the CGST Rules, 2017, the same will be considered as contravention of rules. As per Section 122 of the CGST Act, 2017, a taxable person who transports any taxable goods without the cover of

specified documents (e-way bill is one of the specified documents) shall be liable to a penalty of

Rs.10,000/- or tax sought to be evaded (wherever applicable) whichever is greater. https://e-waybill1.blogspot.com/

8. Consolidated E-way Bill

where multiple consignments are intended to be transported in one conveyance, the transporter may

indicate the serial number of e-way bills generated in respect of each such consignment electronically

on the common portal and a consolidated e-way bill in FORM GST EWB-02 maybe generated by him on the said common portal prior to the movement of goods.

9. Rejection of E-way Bill

Where the person to whom the information specified in sub-rule (11) has been made available does

not communicate his acceptance or rejection within seventy two hours of the details being made

available to him on the common portal, or the time of delivery of goods whichever is earlier, it shall

be deemed that he has accepted the said details. https://e-waybill1.blogspot.com/

https://ambedakarjayanti.blogspot.com/

https://e-waybill1.blogspot.com/

https://coronalockdown-2020.blogspot.com/

https://nifty50stockmkt.blogspot.com/

https://sensex11.blogspot.com/

https://whatsapphindistatus1.blogspot.com/

https://selfreliantindiamovement.blogspot.com/